There is available information from ten (10) of the twenty-four (24) cooperatives inn Alabama which is the lowest level of transparency in the twelve (12) states of the South. Men are 48.5% of the state

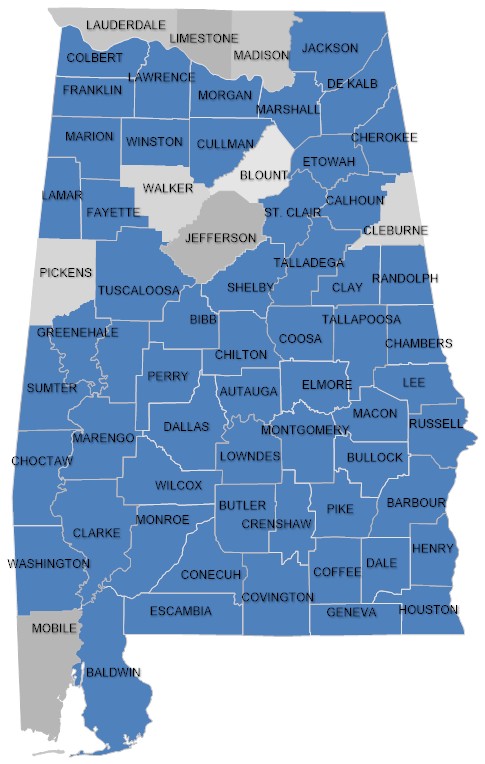

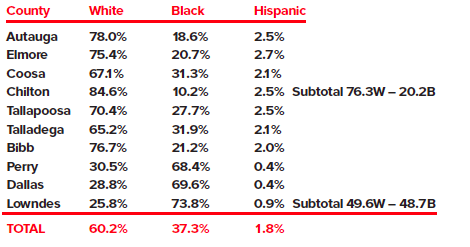

population, but hold 90.4% of the cooperative board seats. Women are 51.5% of the population, and hold 10.9% of the seats on coop boards. Racially, Alabama is 67% white, 26.7%, and 4.1% Hispanic. Available data on coop participation indicates that 148 members or 95.5% are white, seven (7) are black or 4.5%, and zero (0) are Hispanic.

Alabama Rural Electric Association of Cooperatives

Arab Electric Cooperative

Baldwin EMC

Black Warrior EMC

Central Alabama Electric Cooperative

Cherokee Electric Cooperative

Clarke-Washington EMC

CoosaValley Electric Cooperative

Covington Electric Cooperative

Cullman Electric Cooperative

Dixie Electric Cooperative

Franklin Electric Cooperative

Joe Wheeler EMC

Marshall-DeKalb Electric Cooperative

North Alabama Electric Cooperative

Pea River Electric Cooperative

Pioneer Electric Cooperative Inc.

PowerSouth Energy Cooperative

Sand Mountain Electric Cooperative

South Alabama Electric Cooperative

Tallapoosa River Electric Cooperative

Tombigbee Electric Cooperative

Wiregrass Electric Cooperative![]()

![]()

![]()

![]()

![]()

![]()